Impulse Buying: What Is Impulse Buying and How To Stop [FREE PRINTABLE

Do you struggle with impulse buying? Just a couple of bucks here, couple of bucks there. Impulse buying adds up quickly.

According to slickdeals.net, In 2021, the average person will spend $276 per month on impulse purchases, that’s $3,312 a year or $9 a day.

What Are Examples of Impulse Buying?

Here are some of the most popular impulse purchases that add up quickly and we often don’t even realize we are impulse spending.

- Snacks at the grocery store

- “On sale/clearance” items

- Food/drinks/snacks in the checkout line

- Clothing and shoes

- Books

- Coffee and takeout

- Home improvement purchases

- Products from ads on tv or social media

- Products influencers talk about

- Candles and home décor

Why Do We Impulse Spend?

There are four main reasons why we impulse spend. Are you guilty of any of these reasons to impulse spend?

We think we are getting a “good deal”

Have you been guilty of buying an item (especially clothing) just because it was on sale or “such a great deal”?

When I was in college, I had a spending problem and would buy clothes JUST because they were on sale.

“How can I turn down this shirt, its only $6.99?”

Did it fit me well? Nope.

Was it quality material? Nope.

Was it on sale? Yup.

And that was all that mattered to me.

Those items are not a great deal if they are going to get stretched out and you can only wear it a couple of times.

Or even worse, you can’t even wear it until you lose 10 pounds.

Repeat after me:

“I no longer buy clothes that will only fit my ‘future body’, but I buy clothes that make me feel confident right now!”

Not buying quality items isn’t just for clothes, but also tools, household items, basically anything that can break.

Yes, it may cost you more upfront, but its important to invest in quality items, especially as you move out of the scarcity mindset and can afford quality.

Our emotions cause us to impulse spend.

We are celebrating. Raise your hand if you have ever wanted to go shopping because you are celebrating. You just got a promotion or a raise, or you are dating someone new and want to get a new outfit.

We are sad. My boyfriend just broke up with me, I now want to go to the mall and distract myself by shopping.

Out of spite. My spouse just went and bought a new fishing rod without asking so now I’m going to go buy myself a new purse.

Letting our emotions control our spending is a very dangerous rabbit hole to go down into.

Yes, there are times to celebrate and mourn but do it within your budget.

Get your own easy to use budget here.

If you prefer pen and paper, check out this easy-to-use Budget Printable.

Give yourself permission to spend without guilt.

If you are new around here you may have noticed that my blog’s name is Freedom In A Budget, and wondered what that meant. Isn’t that contradicting? Budgets mean I can’t spend money and are for poor people, right?

Nope! That couldn’t be further from the truth!

Let me bring you back to when I first started budgeting and was paying off my student loans back in 2015.

I remember going out to lunch and feeling SO GUILTY for spending $12 on a lunch out with a group of friends after church.

I felt like that money should be going towards my student loan debt.

Yes, those little lunches add up quick and could make a big difference on my debt but I had an aha moment.

That night I sat down with my budget and adjusted my budget to give myself a $50 a month eating out budget.

Immediately the guilt went away. I gave myself permission to spend.

When I stopped depriving myself and feeling guilty every time I spent any money I started enjoying my money and still hit my financial goals.

I honestly think it made me pay off my student loans faster because I would dream of the day being debt free and be able to pick up the tab for the whole table and leave a massive tip for the waiter. And now I’ve done that… many times!

If you aren’t on a written budget, get on one. It will change your life. Here is the exact spreadsheet that I still use to this day and used to pay off all my debt, pay cash for my dream wedding, cash for my Jeep Cherokee and buy my first house. Watch this video to show step by step how to set up your budget, make it personal for you and your financial goals.

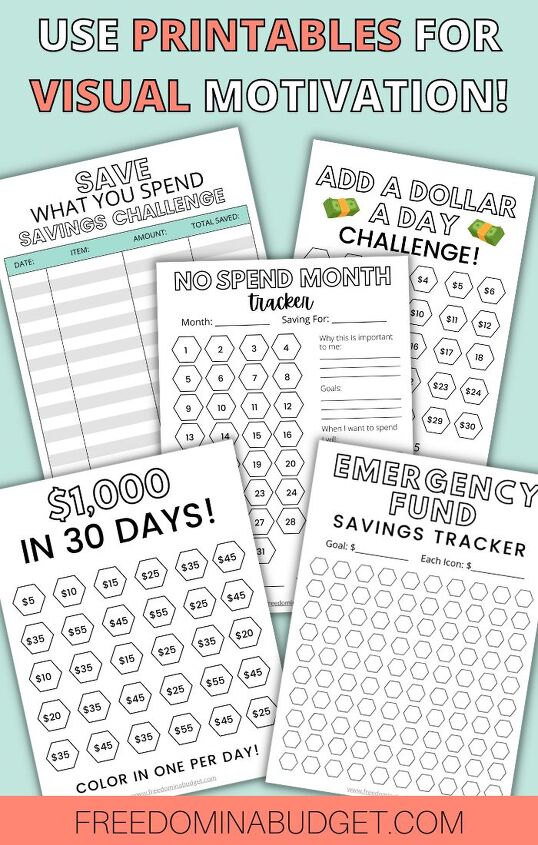

Do a savings challenge

Savings challenges are a way to make saving money or paying off debt into a game.

Every time you get a $5 bill save it with the $5 Savings Challenge.

What’s the weather outside? Every Wednesday save the same amount as the temperature is outside with the Wednesday Weather Challenge.

Check out these fun Savings Challenge videos:

- 12 EASY SAVINGS CHALLENGES | A Full Year of Savings Challenges

- 5 EASY Savings Challenges in 2022 | Easy Ways To Save THOUSANDS $$

- 5 Savings Challenges in 2023

- 5 EASY Savings Challenges That Will Help You Save THOUSANDS in 2023

- Money Savings Challenges That Will Change Your Life

- Savings Challenges in 2023

Visual motivation printables also shows you how far you’ve come and how close you are to your goal is one of the best ways to hit your financial goals faster.

Using printables and savings challenges will motivate your to think twice about a purchase because you want to put the money towards the challenge instead.

More ways to save!

- CIT Bank: BEST High-yield savings account; your bank shouldn’t be charging you money. Instead, YOU should be making money off your money!

- Ladder: Get a quick, free quote on term life insurance, affordable, online term life insurance. No exam! No waiting! No hassles!

- GetUpside: Earn 20 cents per gallon on gas cash back when you download the app and use code FIAB20.

- Fetch Rewards is a free grocery savings app that rewards you just for snapping pictures of your receipts. That’s it. Really. Free gift cards on groceries on thousands of products every day, no matter where you get your groceries. Just scan your receipts and get gift cards from retailers like Amazon, Target, Ulta, Applebees. Use code QHKBH to earn 2,000 points ($2)!

- GoodRx: Free app that provides you savings of up to 80% on your prescriptions (even if you don’t have insurance). $5 sign up bonus!

- Rakuten: Get cash back on online purchases and automatic coupons and savings with their browser plugin… and remember, you have to make a $20 purchase to get your $20 for free!

- Blooom: FREE 401(k) or IRA analyzer, Let the experts take a peek at your retirement account. Get real advice on how it’s doing and how it could be performing better.

- Lively: A modern health savings account. Prepare for tomorrow by making smart decisions about finances and healthcare today. Lively HSAs are free for individuals and families, so you never have to worry about hidden costs.

- Build Wealth by Investing in Index Funds Course: I’ve teamed up with my friend Jeremy from Personal Finance Club to teach you everything you need to know to invest in index funds! How to open an account, how much to invest, and how to choose an index fund. You’ll gain the knowledge and confidence to optimally invest and build wealth for decades.

Focus on your goals and your why

Why do you want to get out of debt? Why do you want to be financially independent?

Having a goal to “be debt-free” isn’t enough.

You need to know your WHY.

Is your why to not have to worry about your power being turned off month after month?

Is your why to give your kids a better life than you ever had?

Is your why to be able to pay for the struggling single mom with a cart full of groceries in front of you at the checkout lane without even thinking twice?

Is your why to travel the world with your kids, show them there’s life beyond the table screen?

Write it at the top of your budget so every time you go into your budget it isn’t just about the numbers but a reminder for why you are working hard.

Only check out once a week

I recently did a survey on my YouTube channel and 70% of those that voted said they make a purchase from Amazon a minimum of 3 times a week.

Are you guilty of impulse purchases from Amazon?

Try checking out only one time per week. Add items to your cart throughout the week like you typically do, but pick one day a week to sit down, go through your cart and evaluate each item.

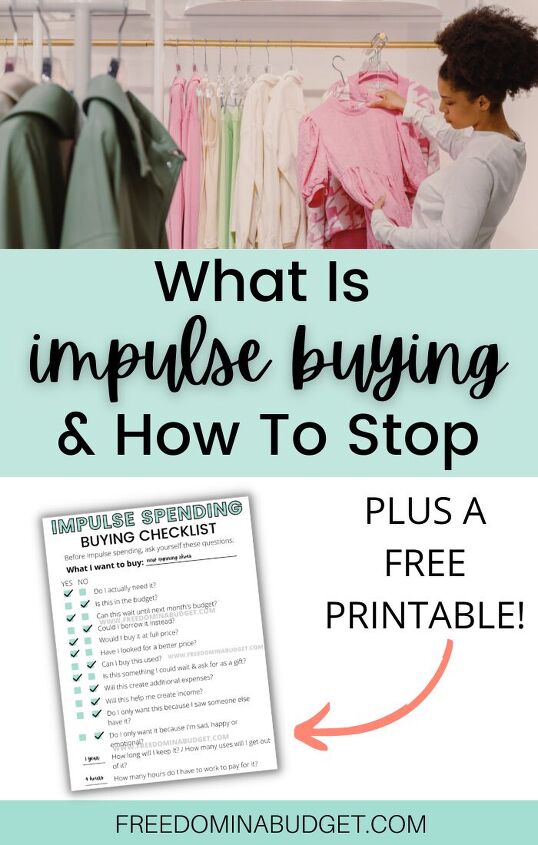

Go through the Impulse Purchase Checklist (FREEBIE at the end of this blog) to really see if it is an item you need right now or not.

If it passes through the checklist and is something you need, great but if not remove it or save it for later or add it to an Amazon Wish List.

Create an Amazon Wish List

If there are items in your cart that you don’t need right now but would like them in the future, create an Amazon Wish List.

At all times I have an ongoing Amazon Wish List that I add to throughout the year.

Then when my husband or family asks me what I want for my birthday or Christmas I don’t have to shrug my shoulders and tell them I’ll think of some ideas and then never do.

This is a win win for everyone, it’s a win for me because then I’m getting gifts that I actually want and will use, it’s a win for my husband or family because it takes the guesswork out of wondering if I will like the random gift they pick up front Target last minute.

Remove saved cards from your web browser

When online shopping, it’s so easy to see something you like and buy it without thinking twice.

Remove any saved debit or credit cards from your web browser.

You will be surprised how much you think twice about a purchase if you have to physically get off the couch, go to your wallet, and physically enter in your card information.

Avoid impulse purchases by shopping with a plan in mind

Whether you are going to the grocery store or to Target, always go with a list of what you need.

It is way too easy to just browse and add random items to your cart because they look good at the time.

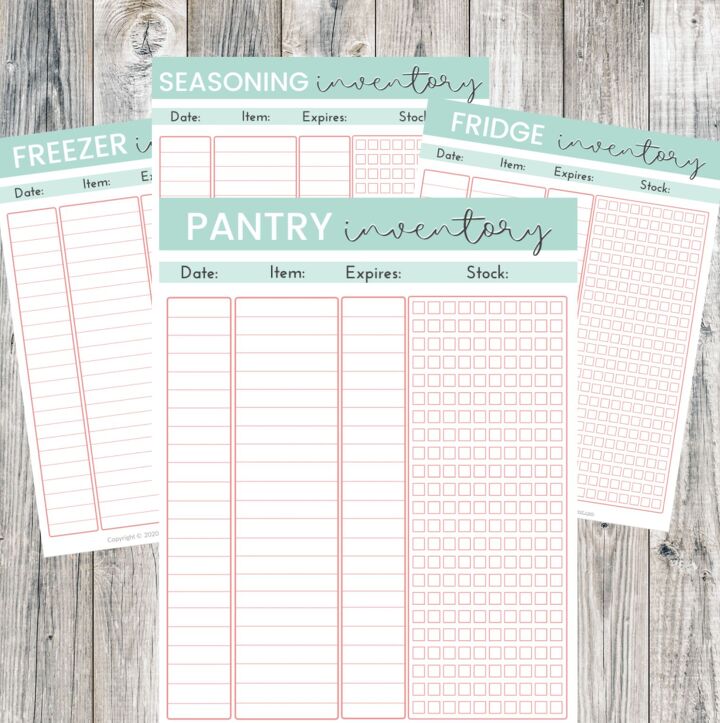

Before you go grocery shopping, look through your pantry, fridge, and freezer to see what you already have so you don’t have to buy multiples. Use these Food Inventory Printables to keep track of what you have on hand.

If you struggle with impulse spending don’t go to places like Target or Marshall’s to just browse or kill time, always go with a plan of action or don’t go at all.

Stop the comparisons

Comparison is the thief of joy… and budgets.

Do you find yourself scrolling Instagram and comparing yourself to people on social media, or your friends, or coworkers, or neighbors?

Ask yourself: If no one saw this item I want to buy, would you still buy it?

The fancy car?

The Rolex?

The designer purse?

The fake lashes or nails?

We will quickly reply with “no it’s because *I* want it… but is it?

Some of the links in this article are "affiliate links", a link with a special tracking code. This means if you click on an affiliate link and purchase the item, we will receive an affiliate commission.

The price of the item is the same whether it is an affiliate link or not. Regardless, we only recommend products or services we believe will add value to our readers.

By using the affiliate links, you are helping support my blog, and we genuinely appreciate your support.

![101 Items to Get Rid of With No Regret [Free Declutter List]](https://cdn-fastly.thesimplifydaily.com/media/2022/08/30/8349390/101-items-to-get-rid-of-with-no-regret-free-declutter-list.jpg?size=350x220)

Comments

Join the conversation