How to Live Frugally & Retire Early - 6 Ways to Save Money

Frugality means doing whatever it takes to get 1% more efficient. It means optimization and living with less. Make it a game if you want to live frugally to retire early.

There is a difference between being frugal and being cheap. Being frugal so you can retire early is about cutting out the big expenses without going to extremes.

The average American spends about 33% of their budget on housing, about 17% on their transportation, and about 12% on their food. Then you have insurance, healthcare, and entertainment in smaller amounts.

Instead of cutting out little things like going out for coffee or small entertainment expenditures, it's better to focus on the big stuff. I am a huge proponent of house hacking; I chopped off 33% of my budget just by doing house hacking.

That gives you so much freedom to take an extra 5% or 10%, put it into entertainment, and have great experiences. By being frugal on the larger expenses, you'll still be living frugally so you can retire early.

1. Saving on transportation

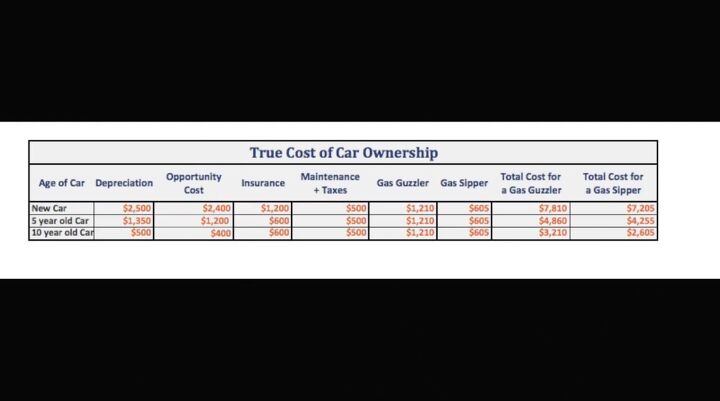

A new car is unnecessary when your goal is to get from point A to point B. Instead of spending 17% of my money on a car; I drive a 2008 Honda Civic. I paid cash for it, so there are no payments and no debt.

What is important is how much you keep, not how much you make. If I were doing things differently and went out and got a brand-new car, I would not be saving as much. I would have to make a lot more to keep my savings rate the same. You need to have a goal or you're not going to have any incentive to try to make these changes.

My goal is to retire early from wage-paying work. Not saying that I'll be retired totally, but I'll be able to focus on real estate investing and making creative content and other activities I want to do.

2. Saving on housing

Get a roommate to drop your monthly expenses. By getting a roommate, you're splitting expenses and can save that money instead. Another way to save money would be to get a smaller apartment

closer to work to save money on housing and gas costs.

Cutting out those big expenses is key to living frugally enough to retire early.

We've cut some out of almost 50% of our expenses by cutting expenses on transportation and housing.

3. Saving on food

I buy all healthy organic food, lots of fruits, vegetables, and meat, but I don't go to dinner often. I found that I don't feel as well when I go out and eat unhealthy food at restaurants. I'd much prefer to make food at home.

When I'm making food at home with my wife, we produce it in batches so that we can have it for a few days for a few different meals. We don't spend as much time making each of those meals individually or as much money making those meals. I'm also able to take leftovers to work, so I'm not tempted to go out and grab fast food, which you will regret after you do it.

4. Stop buying unnecessarily

I have a quote that I like. Don't buy things you can't afford, with money you don't have, to impress people you don't like.

Many people get into a pattern of buying things and getting more things, and things don't make them happy. We found that when we got rid of a lot of the stuff here in our apartment, we got a lot happier because there was a cleaner environment.

We're just happy with our experiences like travel, being with the ones that we love, and our friends instead of always trying to get that little high out of buying something new.

You might feel better directly after buying something, but down the road, that won't add any value to your life. It's about spending on things that add value to your life, like travel or dinner with your friends. If it doesn't add value, just cut it out completely.

5. Saving on entertainment

I believe the average American watches about 5 hours of television a day. We do not have a TV, and we don't have cable. When we had a TV, I was much more prone to video games and wasted a lot of time.

That is a huge chunk of your life that you're spending, not adding value to your life or other people's lives. I'm a lot happier since we eliminated the television, which also saves money on cable bills.

We have my laptop and Netflix and streaming, which

is a much more affordable option. It also makes it just a little harder to binge-watch things and waste an entire day and not better yourself.

6. Why you're doing this

The last thing I wanted to discuss here is why you are doing this. When you can save, you want to save up that 1st $25,000. If you focus on this, it might take a year or two. Then you're able to start having enough to start investing. If you don't have money to invest, then you'll never be able to have your money work for you.

You need to be frugal at the beginning to save up that initial money you're able to invest, making it much easier down the line.

The whole reason for being frugal is to build up the initial chunk of money so that you can start investing. Then you're able to invest in a house. If you buy a multifamily unit and you rent out the other ones, you're going to be money because you're not going to end up having to put any more money into the house payment each month saving 30% of your budget.

How to live frugally and retire early

I hope my tips help you to live frugally so you can retire early. The whole goal is to save up that initial money so you can start snowballing it. You'll begin to grow that money to create even more savings.

Comments

Join the conversation

♥️

Great article, i have practices most of your hints for more than 20 years!!!

When the hospital I worked in showed signs of trouble and a possibility that I may be unemployed, realized that my children and I would only be okay if I did not have a 15 years mortgage left. With my salary only, I paid off my mortgage in only 6 years. This was the best thing I could have done for my family. I was very tight on myself but still gave my children what they needed..

After I was mortgage free, I started to banking half of my salary.

Because I knew how to save, I felt confident to retire at 62 years old.