What Happened With the SVB Failure & How to Protect Your Money

You have probably been hearing a lot about the Silicon Valley Bank collapse on the news lately. The SVB failure was the largest bank failure since 2008 when Washington Mutual failed.

This makes a lot of people worry about the money in their bank account and consider pulling it out of the bank. Today, I want to address the SVB failure, explain what happened and how, and help you understand how to protect your money.

How do banks normally operate?

As a customer, you would open an account with any bank out there and deposit some money into it, whether that is a large bank like Chase, Bank of America, Wells Fargo, etc, or something smaller and more local.

The bank is a business, so they do need to make money somehow. Yes, they do lend out loans and mortgages, and they get money from credit card interest, but they also make money by investing. They could invest in stocks, and government securities, like treasury bonds, commercial real estate, and so on.

A little bit of their money they hold in a cash reserve. That way, you can take out money from your checking account in one day whenever you decide. This process is what allows the banks to pay their employees, pay us our interest on our high-yield savings accounts, and such.

What happened with SVB?

Many of the customers with this bank were startup companies in the tech sector. A startup typically has a lot of money to start with, and they need to put that money somewhere, so a lot of them chose SVB.

SVB invested the bulk of its money into US Treasury securities, and by the end of December 2022, that was not worth as much as they had purchased it for.

This is the same as if you bought a stock at $100 and it went down to $80 by the end of the year, only on a bigger scale.

As soon as SVB’s customers, who were mainly startups, heard the news, they started pulling their money out, which was hundreds of millions of dollars. As this kept happening, the news continued to get out, which made even more clients pull their money.

This means that SVB was forced to use their cash reserve, which they ran through pretty quickly. Next, they had to sell off their assets, but because the market was down, they did not have enough money to cover what they needed.

The bank still had loans and mortgages out there, but that is not liquid money, so it would not be repaid immediately.

What happened to SVB customers?

If somebody needed $100 million after SVB had already depleted hundreds of millions of dollars to their other customers, there was no more left for that specific customer.

A big problem here is that if you put $100 million into a bank, only $250,000 of that is FDIC (Federal Deposit Insurance Corporation) insured. So if you put $100,000 into a bank, you should be good, but 100 million is a different story.

Many customers lost a lot of money, and of course, they are still dealing with that. For most individuals who use that bank, this is not critical, since the $250,000 are FDIC insured. Even if it were to be delayed, you would eventually get your money.

However, the startups that had millions of dollars in this bank may have to go out of business or not be able to pay their employees.

Should I be worried about my assets?

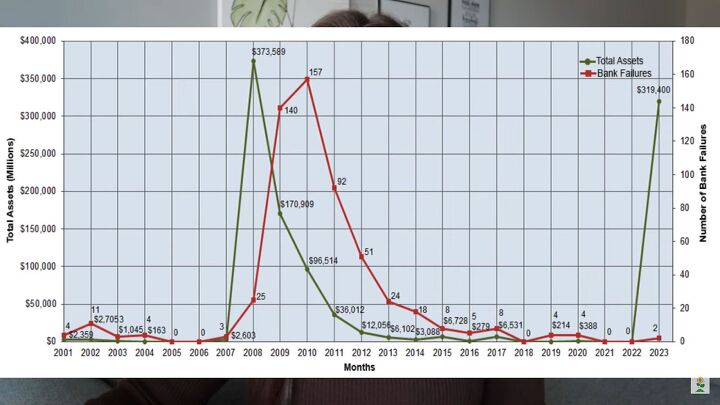

In short, the answer is no. First, I want to point out that bank failures are not that uncommon. In the time from 2001 until 2023, there have been 562 bank failures. This one was a big one, as well as the failure with Washington Mutual in 2008, but overall, this is a rather common thing to happen.

On the FDIC website, you can look at the statistics of how many banks failed each year. If you do, you will notice something similar about all of these: the banks that have failed throughout the years are primarily small local banks. You are not going to see Bank of America, Chase, or Goldman Sachs on that list.

As much as people may hate these larger banks because of their fees and customer service, your money should be good in those larger banks because they have many customers and therefore a lot of money. They diversify where they put their money and they have been in business for a very long time.

How do I protect my money?

1. Choose a bigger bank.

If you are banking with a smaller local bank, consider the reasons explained above and think about whether you would like to make a switch.

2. Choose an FDIC-insured bank.

Almost every bank at this point is FDIC insured. If it is one of those big banks, you are good for sure, but if you are using a smaller local bank, double-check that it is FDIC insured.

3. Do not hold more than $250,000 in an individual bank.

Typically, FDIC insurance is for up to $250,000, so if any of your money is lost for whatever reason, then only $250,000 is sure to make it back to you. If you have 250K in one bank, put the rest in a different bank.

4. Spread your money in multiple places.

If you are still worried, open up multiple checking accounts, save some cash, or put some money into a high-yield savings account. That way, if one bank happens to go down, which again is very unlikely, you have money elsewhere while you wait for the funds to come in.

How does the SVB collapse impact us?

As I said at the beginning, I hope this did not affect any of you. I will say that now is a good time to invest in the market. You have probably noticed that the S&P 500 went down, as well as other index funds, because of all the chaos in the finance world.

Therefore, if you are in a good place for investing, you have the extra cash and that is part of your plan, definitely look into purchasing some index funds or stocks at the moment.

How to protect your money

Hopefully, this article helped to clarify the situation and put your mind at ease a little. What bank do you use? Are you making any changes after the SVB failure? Let me know how you are feeling in the comments!

Comments

Join the conversation