How to Save 10k Fast: 5 Life-Changing, Money-Saving Tips

I want to offer some advice on how to save 10k fast. Statistics show that 69% of American adults have less than $1,000 in their savings account. How do we go from nothing to saving up $10,000 inside of one year? This probably sounds impossible, especially when you're starting at zero, but I have done it myself. All it comes down to is following some simple steps.

1. Set it as a goal

Take some time and think about why building up your savings is important for you. It will alleviate stress. You won't be living paycheck to paycheck. If you get fired, it won't put you into debt. For a lot of us, this can be a life-changing amount of money.

2. Write it down

You are 42% more likely to achieve your goal if you write it down. Plaster it on your wall or put up a sticky note. Oftentimes we fail at our goals and the reason behind that is we lose motivation.

Once you know what the ‘why’ behind your goal is, write it down and put it somewhere you’ll see often. I have a bottle of temporary tattoos and I write down different goals on my wrist so that I see them every single day.

3. Put your money somewhere where you can't get to it

Before we get into exactly where the money is going to come from, we have to decide where the money is going to go once we have it, so that we actually hang on to the money. I recommend one of two different options.

The first option would be a high-interest savings account so that you can at least gain %1 to 2% on your money while it's sitting there for a year. just pretend that it does not exist.

If you're okay with a little more risk, the second option is to invest the money into the stock market. I wouldn't recommend just picking stocks. On average most people who pick stocks actually underperform the market and end up losing money. Instead, think about getting something like an index fund.

Historically, index funds have earned about 10% over the past hundred years. An index fund is simple and low-risk, so you don't have to think about it. It’s a great way to have your money working for you and really take advantage of compound interest while it sits in the bank.

4. Start a side hustle

If you're anything like I was when I was getting started, you might not be making a ton of money. Try using a side hustle to earn extra money. Keep all the money you earn from the side hustle and put it into savings.

I am a bit of a side hustle addict. I think it's one of the best ways to earn some extra money. Side hustles could be the thing that catapults you into building wealth and getting out of debt.

My YouTube channel started as a side hustle for me and turned into my full-time work. I have also done around a dozen other side hustles that I had a lot of fun with. One of my personal favorite side hustles is flipping things on Craigslist or Facebook Marketplace. With a bit of research, this is not hard to do. If you enjoy that kind of wheeling and dealing type of thing, it can be really fun.

Another good side hustle is cleaning houses with your own cleaning supplies. You can easily make $50-$75 an hour cleaning other peoples’ houses. It’s not super fun, but it's good money. You can mow lawns or start a social media channel. My wife just started TikTok.

I know a couple of people who started different social media sites. Simply by posting consistently for a few months, they were able to monetize and start making between hundreds and thousands of dollars every single month. The only thing is you've got to stick with it.

Maybe there’s something that you really enjoy doing and talking about. You can teach somebody online or in person. Use your hobbies and things you enjoy to start making extra money.

5. When in doubt, frugal out

Frugal living has been the number one thing that has completely changed my life. We've all heard that a dollar saved is a dollar earned. That is not necessarily true. If you earn $1, you have to pay taxes on that dollar and then you have $0.70 left over. So, a dollar earned is $0.70 earned.

One of the things that can make the biggest impact right away is being frugal and saving money. Instead of focusing on earning more money, which is also extremely important, it can be more efficient and have a quicker impact to start by spending less.

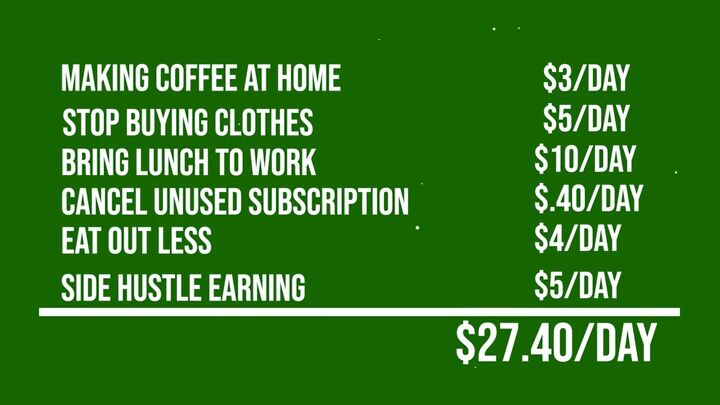

When you break down that goal of $10,000, what you need to save every month is $833. This still sounds like a lot, but it’s just $27.40 a day. Find small ways to save wherever you can:

- Making coffee at home will save you $3 a day.

- Stop buying clothes that you don't absolutely need to save $150 a month, or $5 a day.

- Bring food and water to work instead of going out to lunch and getting a soda every day. That’s another $10 saved.

- Cancel one unused subscription to save $12 a month, or $0.40 a day.

- Go out to dinner a few times less per month and save $125 in a month, or $4 a day.

Then all you need to earn from your side hustles is $5 a day, which is pretty doable. Making those five small sacrifices and letting that saved money compound over a year will completely change your life.

How to save 10k fast

$10,000 is a lot of money. It may sound like an overwhelming amount to save in a year, but it is a lot easier than you would think. I hope my simple, manageable methods help you stick to your goal of saving 10K in one year.

Comments

Join the conversation

One thing that also works is to think of a cheaper way to do what you used to do. For example, now when I go out with friends I always order ice water and an appetizer or a large bowl of soup rather than an entree. I enjoy being with them, but for less than half the price of what I used to pay going out. I buy all my cards at the Dollar Store - they have some lovely designs.

I save every $10 bill that I get throughout the year. I've managed to save close to $3,000.00. I start saving on my birthday and continue until my next birthday. Maybe I'll try $20 bills next year. It's a great way to save money for me. I just fold the money up and put in in a coffee can. I also save my change every day, wrap it to take to bank at the end of the year also.

Mona