How to Keep Track of Vacation Spending With a Cashless Budget

I prefer cash because it keeps me accountable. If I use a card, I’ll swipe like there’s no tomorrow. However, I am traveling this week and am not somebody who travels with cash.

I don’t feel safe carrying around cash when I don’t know the area. So, we’re going to make a cashless budget, showing you how to keep track of daily spending on vacation.

Making a budget

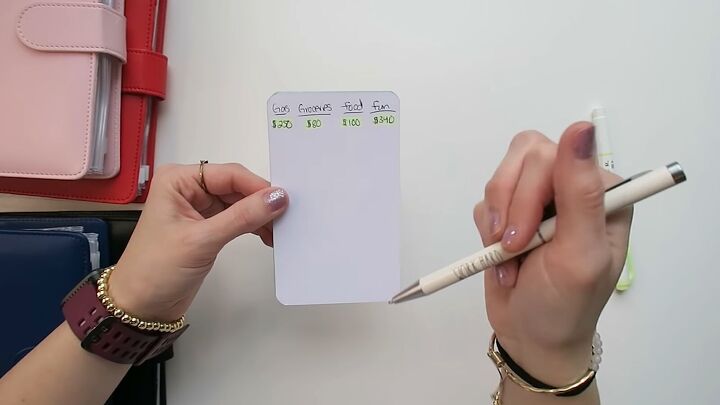

For me, there are four variable spending categories I budget for weekly: gas, groceries, food, and fun. Once I’ve established the four categories, I need to set my budget.

For a weekly budget, gas is typically $30, groceries are $120, food (or fast food/eating out) is $20, and then fun I’ll pull from spending money, or fun or self-care money. That’s not something I typically have a weekly budget for, although you absolutely could.

That would be my typical numbers. However, since I’m traveling, the vacation week budget is going to be a little higher.

Gas

For gas, I’m expecting to pay about $250, because I’m driving from South Mississippi all the way to Nashville, Tennessee.

Groceries

For groceries, I’m budgeting $80. I’m staying in an Airbnb, so I’ll have a whole kitchen.

Food

Food (eating out) is something we would only typically have $20 for, but I’m splurging and giving us $100 for food during our vacation on a budget. That’s relatively low, but it’s just me and my two little boys. Food isn’t something we put a big priority on.

Fun

For fun, I’m going to give us a $340 budget.

I’ve put this budget on an index card, so I can easily put it in my purse and carry it around.

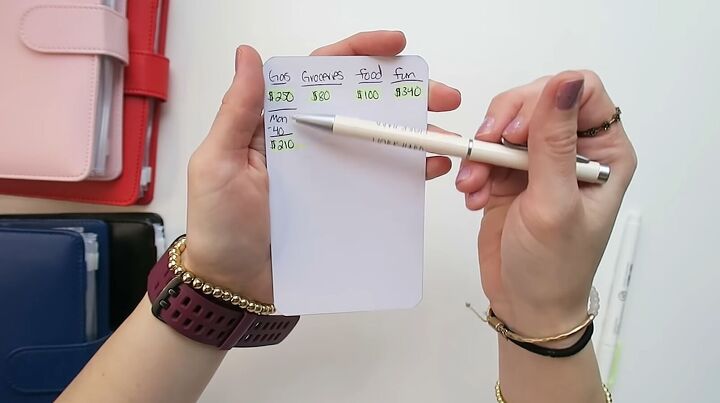

During the vacation, I’ll track it the following way. Let’s say on my trip on Monday I get $40 worth of gas, I would write “Monday- $40,” and then write that I have $210 left. I would keep a tally going down the gas column showing how much I spend on it. Same for groceries, food, and fun.

Pulling from my binders

Because I typically use a cash budget, let’s use my cash binders to see where I am at in savings for this vacation.

I’ll go through my cash binders and pull cash from savings categories like winter vacation or any other savings accounts relevant to my trip (for example if you were saving money for a zoo trip and for vacation, you could pull from both binders).

In addition to my winter vacation savings money, I can also pull my typically budgeted grocery money for the week (the typical $120 that I set aside weekly for groceries), along with the gas money ($30), and food money ($20) that I’ve allotted for that week.

There’s no reason I can’t put that cash towards my variable spending during my vacation on a budget.

I’m going to write down how much the vacation savings and typically budgeted amount cover, and realistically what else I will need, even if it exceeds what my present budget is limited to.

I don’t want to go on this vacation, spend all this gas money, and not have any fun money, just because I don’t have it yet. I’m going to be putting some of the extra vacation spending on my credit card, but I’m still giving myself a limit for my fun variable spending — $340.

Ideally, I would have these numbers figured out in advance and would’ve saved for them in advance. It just didn’t happen. That’s why I’m going cashless and putting the extra money on my credit card.

After adding everything up, and subtracting the amount I plan to spend on the variable categories during the vacation week, we are going over the budgeted money plus the vacation savings by $360. I will be putting this on a credit card.

Keep in mind that I did already put $1,000 towards an Airbnb, and I have gas, groceries, and food covered, so there’s just a bit of fun money that I’ll be paying off over the next few weeks.

Reflecting on the vacation

Future Jordan here. I’m back from my trip and it was absolutely wonderful. I wanted to update you on how I did on the budget in real life.

This is the card I brought with me (below). You can see I didn’t end up tracking what day I spent. When traveling, things are more hectic than in real life. I did track the numbers though. This cashless budget system worked as I intended it to.

Gas

For gas, I budgeted $250. You can see I filled up several times. My total for the entire trip was $175.

Groceries

For groceries, I only spent $60, instead of $80, so I stayed well within my range there.

Food

For food, I overspent. I thought I would only need $100. I ended up spending about $168. I didn’t account for the mall food, eating out at Olive Garden with the boys, and the fact that fast food restaurants are more expensive in Nashville.

These things happen. In the future, when I do go out, I’ll allow myself more money for food during future vacations on a budget.

Fun

For fun, I spent under the allotted amount. I spent $257, instead of $340. We spent time driving around and going to free areas. I wanted to prepare my kids for us moving there and getting them excited about it.

The only thing we didn’t get to do on the trip was go to the zoo. It wasn’t a budget decision. We were just so busy we didn’t have time to go. We were only there for four days.

Paying off the card

For our budget that we planned on the index card, we expected to spend $770 in all categories (don’t forget, I spent $1,000 on an Airbnb that I had already saved for and paid for). The total I spent was $660, so we stayed under budget.

However, this amount was still $350 over what I had saved in advance in the vacation savings binder and weekly variable spending cash binders. I paid for this extra $350 using a credit card.

What I ended up doing to cover the extra cost, was not doing a cash stuffing for our sinking fund during the vacation week. I basically put the $300ish I would have put in the sinking fund towards paying off the credit card.

Cash or cashless budget?

I’ve already evened everything out. It was a great trip and well worth the money spent. I can’t wait to see what next adventure we are saving for.

Do you prefer a cash or cashless budget? Let us know in the comments below.

Comments

Join the conversation